Business Services

We offer complete business services including:

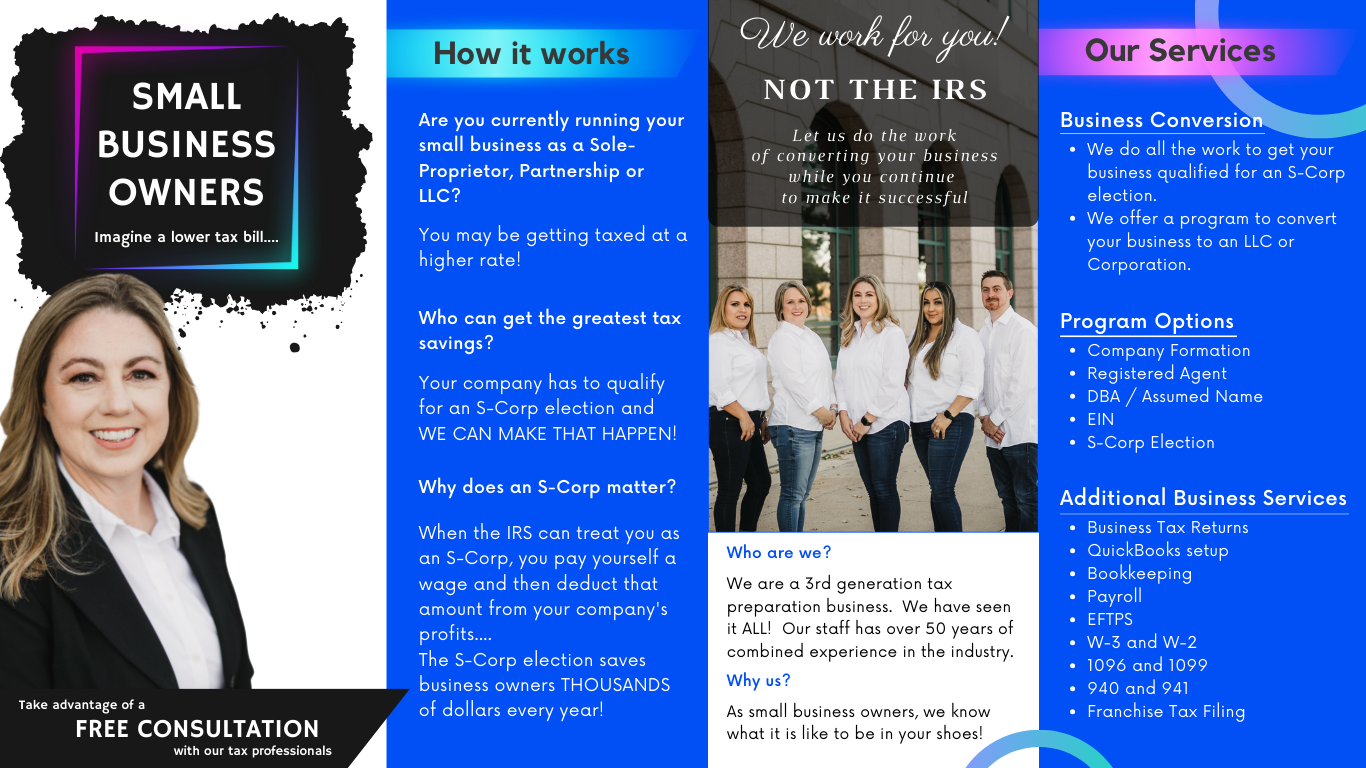

- Small Business and S-Corp Elections

- Business Formation

- FinCEN BOI

- Registered Agent

- Bookkeeping

- Payroll

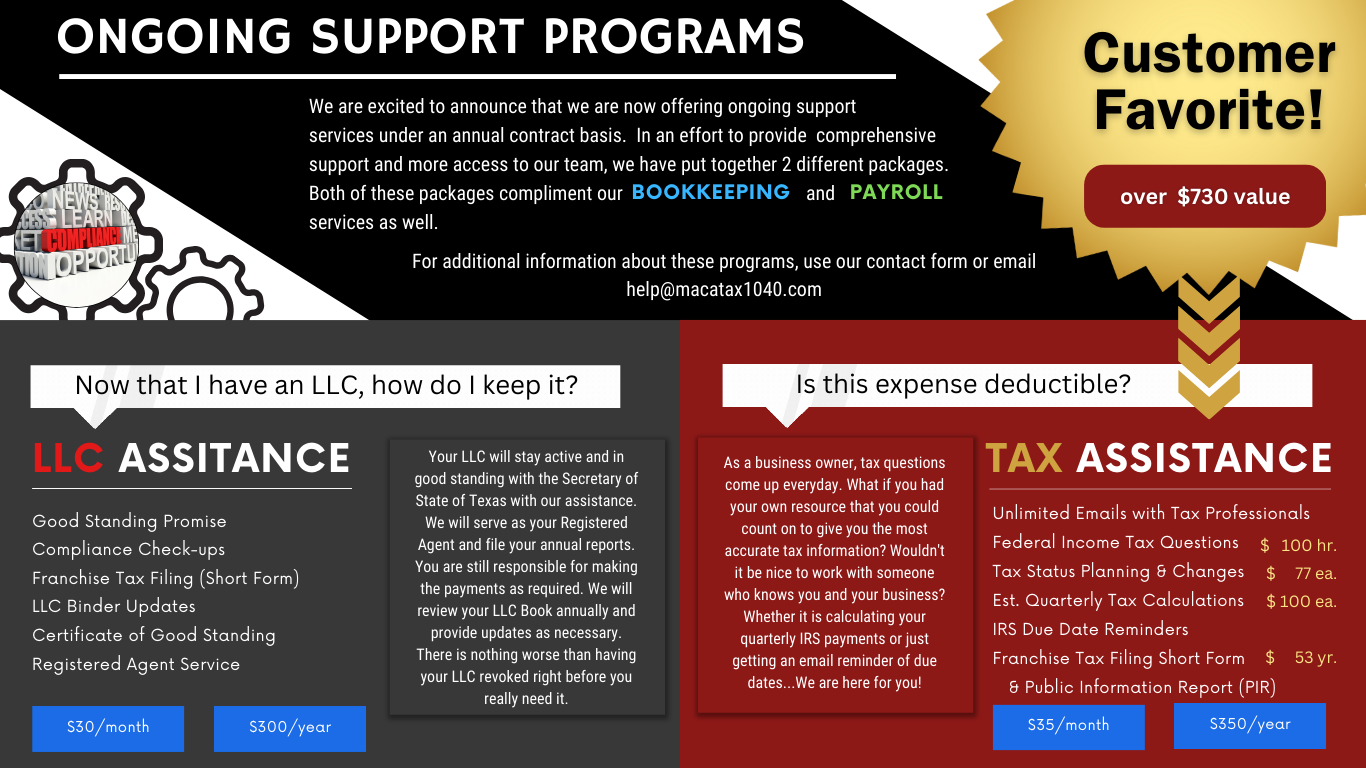

- Ongoing Support

- Sales Tax

- Business Tax Returns

Would you like to know more about S-Corp vs Schedule C? Watch this!

Return to Top

Do you want help becoming an LLC? Watch this!

Return to Top

UPDATE: As of 02/29/2025, The new deadline is March 21, 2025. For more details…

Return to Top

Return to Top

Return to Top

Return to Top

Sales Tax:

We can assist you with your Sales & Reuse Tax Permit application. We have a guide called “Contractors and Sales Tax” for construction companies to help simplify the process. Contact us for details.

Return to Top

Business Tax Returns:

From a small business to a Corporation, even a Non-Profit, we can handle your tax return for you! Schedule an appointment to work with our specialists.

We offer tax prep for:

-

-

-

-

-

-

-

-

-

-

-

- Schedule C: due April 15

- 1120S (S-Corp): due March 15

- 1120 (C-Corp): due April 15

- 1065 (Partnership): due March 15

- 990 (Non-profit): due May 15 (or the 15th day of the 5th month after the end of the fiscal year)

-

-

-

-

-

-

-

-

-

-