Tax Services

Macatax is experienced in many forms of tax preparations!

- Federal Personal Income Taxes: 1040

- Federal Business Tax Returns: 1065, 1120, 1120S

- Federal Non-Profit Returns: 990

- “Other State” Income Taxes

- State of Texas: Franchise Tax (short and long forms)

- State of Texas: Sales & Use Tax

- State of Texas: Mixed Beverage

- Tax Return Extension: Personal

- Tax Return Extension: Business

We also offer a variety of options to get the job done:

-

-

- In person

- New Portal

-

Special Options during Tax Season only:

-

-

- Drop & Go Services

- Express Tax Service

- Easy Advance & Refund Transfers

-

Recommendations:

Small Businesses who file a Schedule C on their personal return, take advantage of our bookkeeping services. We can look over your Quickbooks Online Account to clean up your account. You can also drop off receipts for a quick excel spreadsheet bookkeeping option designed just to complete your tax return. Bookkeeping services are an additional charge.

Small Businesses who file a Business Tax Return (1065 partnership, 1120, 1120S). Send in your documents early to allow us time to work through the return before meeting in person. You can drop off your paperwork using our Drop & Go service. This is a great way to reduce the amount of time you spend in the office. Don’t worry, we will work closely with you and explain every item along the way. You can still come in to the office for a face to face final overview of the return prior to final filing. Federal Business Tax Returns are due March 15th. Extensions are available, delaying filing until September 15th. We do not guarantee any business returns to be completed on time if provided after March 1st.

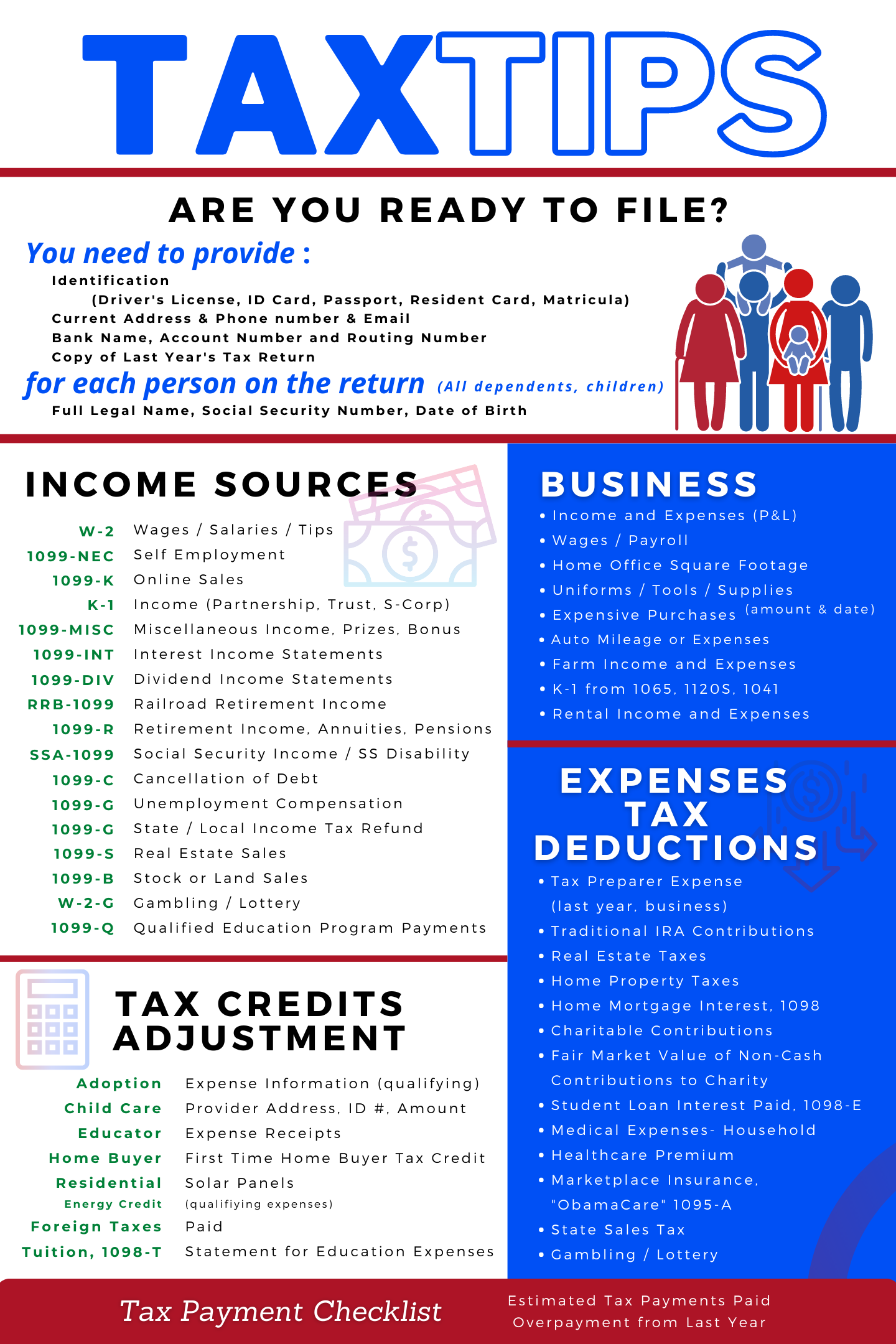

Use this guide to see if you are ready to file: